Canadian Mining Company Deleted Its Accusation that Activist Waterton “Seeded” Article with Bloomberg

When companies face criticism from an activist, it’s common for them to resort to aggressive tactics. But spreading potential mistruths is a dangerous game – with possible ramifications for a company’s board of directors.

Consider the recent action taken by Hudbay Minerals, a Toronto-based mining company under pressure from 12% shareholder Waterton Global Resource Management, a private-equity firm that seeks to replace the majority of the company’s board directors. Chief among Waterton’s concerns are misguided acquisitions and poor shareholder returns over the last decade since current chairman Alan Hibben joined the board.

As part of its defense campaign, Hudbay on April 4 published an information circular (including an introduction letter signed by Mr. Hibben) with a thorough attack on Waterton, including a caricature of the private-equity fund in the form of a snake on the cover page.

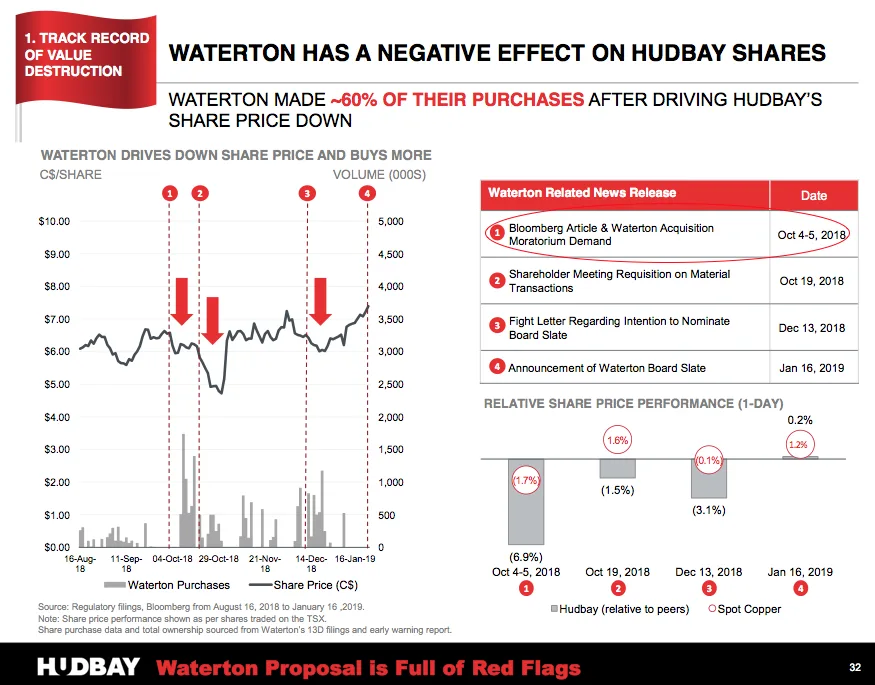

More striking, however, was a description on page 32 of the circular that read “Bloomberg Article Seeded by Waterton” referring to this report detailing Hudbay’s discussions with Chile’s Mantos Copper about a possible acquisition. The apparent insinuation was that Waterton had planted a negative article with Bloomberg in order to depress the share price and build on its stake, which at the time was roughly 4.8% of the company.

Initial Version of Circular

It’s unclear how long the words “Seeded by Waterton” remained in the circular, but as of late last week, they had quietly disappeared without any announcement from the company. Asked about the change, a Hudbay spokesman told CorpGov on Monday that the company “will be commenting publicly in due course.”

Modified Version of Circular

The accusation and its removal are troubling on multiple counts. First, the initial version of the page suggests a top-tier media outlet such as Bloomberg would report merger talks without strong sourcing. More importantly, the revision of the slide indicates the company made a serious public accusation against Waterton but later decided to retract it without explanation.

Corporate governance experts say board directors may bear direct responsibility for such actions, given the significance of the information circular. Lawrence Elbaum, a partner at Vinson & Elkins LLP in New York, isn’t a Canadian lawyer, but is a leading corporate governance attorney and says it is part of a board’s duty to monitor communications such as an information circular.

“Generally, as a principle of good governance, if a board and company are issuing a letter, presentation, or email, they should be responsible for every bit of it – down to punctuation,” Mr. Elbaum said. “As a fiduciary, a company and its board should provide timely, complete and accurate information to investors so they can make proper decisions.”

He added that Hudbay still owes shareholders an explanation for just why it altered language in the circular. “The company has some explaining to do,” he said. “Either they admit they did it and acknowledge they tried to deceive shareholders or try to explain why they didn’t deceive shareholders.”

For its part, Waterton commenced a legal proceeding Monday against Hudbay in Ontario’s Superior Court of Justice. Waterton argues that the information circular was designed to discredit the fund and to mislead shareholders regarding Waterton’s activities to sway their vote. The company issued a statement Tuesday, which said “Hudbay believes that the litigation is frivolous and will vigorously defend itself.”

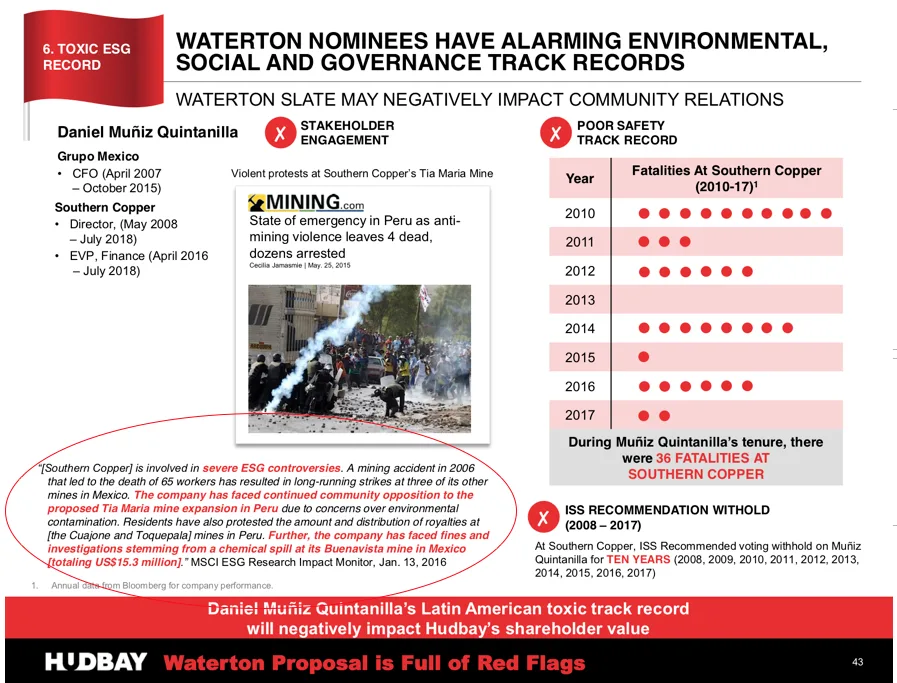

In addition to the alteration Hudbay made to the circular, other items of possible concern remain. One in particular is page 43, which concerns Daniel Muñiz Quintanilla, one of Waterton’s director nominees. The page’s headline reads “Waterton Nominees Have Alarming Environmental, Social, and Governance Track Records.”

Curiously, the slide also contains a block of text regarding Southern Copper, where Mr. Muñiz Quintanilla was a director from 2008 to 2018. The first two sentences of the text read “[Southern Copper] is involved in severe ESG controversies. A mining accident in 2006 that led to the death of 65 workers has resulted in long-running strikes at three of its other mines in Mexico.”

A cursory read of the slide might make someone think Mr. Muñiz Quintanilla was somehow responsible for that accident. But in fact, he was not a director of the company until 2008, two years later.

Asked why the accident was included in the circular, Hudbay’s spokesman said the accident wasn’t meant to be emphasized because it wasn’t highlighted. “So far as I know the block of text was from the report noted,” he told CorpGov. “The information in red, within the block, was meant to be the focus.”

In fairness, there are no outright inaccuracies on slide 43. But the possibility of confusion was enough for Waterton to point out in its legal filing that Mr. Muñiz Quintanilla was actually “practicing law at a boutique law firm” at the time of the accident.

The controversial circular is a reminder of just how serious investor communications should be to a board, especially in the context of a proxy fight. As Mr. Elbaum points out, a company that actually lies to investors may be committing securities fraud. But even short of that, it would behoove board directors to tread carefully when they play hardball with an activist.

Contact:

John Jannarone, Editor-in-Chief

www.CorpGov.com

Twitter: @CorpGovernor