- Republic First Bancorp, Inc. (Nasdaq: FRBK) is under pressure from an activist group led by George Norcross III

- Norcross pushing for Republic First to take $100 million equity investment from the group

- Norcross group expects board seats “commensurate” with investment, which could amount to effective control

- Norcross requests fee of up to 9% in combination with equity investment, far above normal underwriter’s fee

- Fee intended to cover activist-campaign costs including litigation against bank, SEC filings, compensation to Norcross group member Gregory B. Braca

- University of Pennsylvania Law School’s Charles Elson says Norcross group’s proposal is “odd from a corporate governance perspective”

- Republic First has undertaken strategic review with financials-focused investment bank Keefe, Bruyette & Woods, Inc. since September, including consideration of capital injection

- Separate activist investor Abbott Cooper already reached settlement with one board seat in October, tells CorpGov he’s pleased with bank’s direction

- Norcross group has approximately 10% stake vs. 17% stake among board directors, including representative of billionaire Steven A. Cohen, CEO of Point72

Shareholder activists, like powerful politicians, are sometimes known for creative tactics. In the case of Philadelphia-based regional bank Republic First Bancorp, Inc. (Nasdaq: FRBK), a political powerbroker turned shareholder activist has attempted to turn the rules of corporate governance upside down.

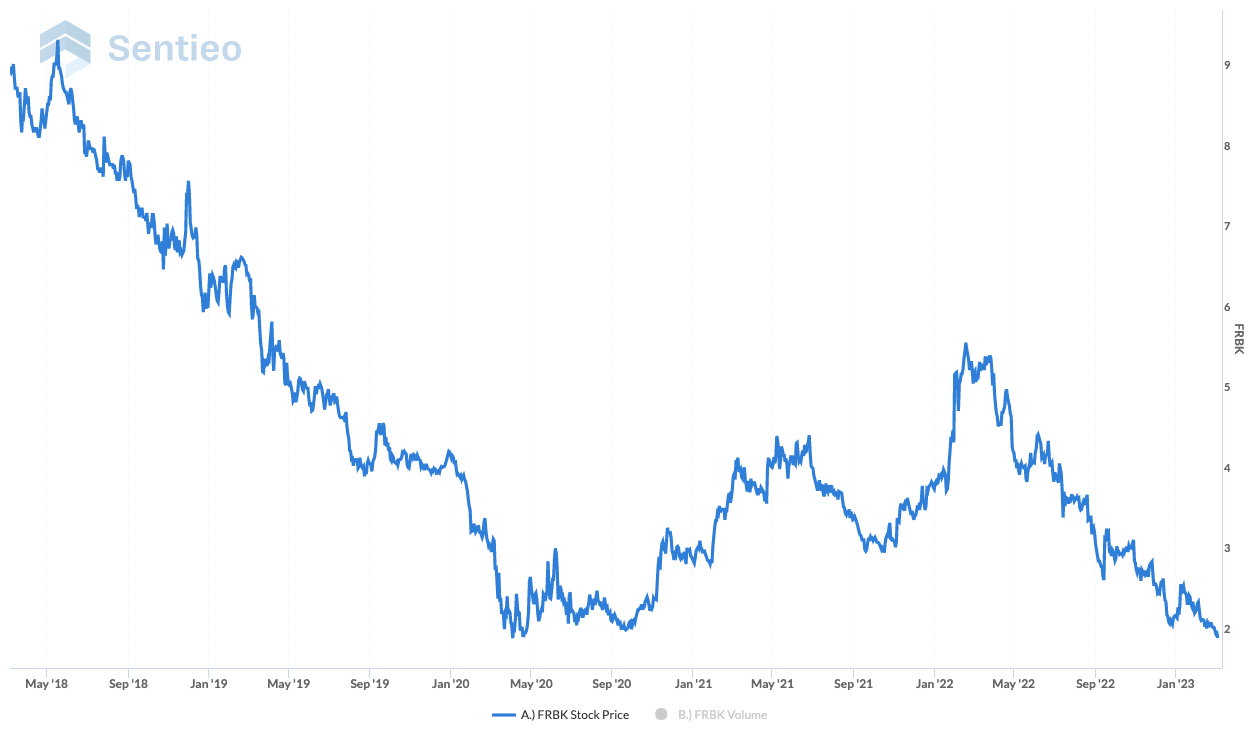

Republic First has taken plenty of punches in recent years as it became apparent that its palatial bank branches weren’t the smartest investments and it piled into long-dated bonds that sunk as interest rates rose. The troubles drew the attention of two activists: One was Abbott Cooper’s Driver Management Company LLC, which settled late last year in exchange for a board seat.

Source: Sentieo

Now, the drama centers on an approach from the second activist group, led by George Norcross III, a Democrat known to be a force in New Jersey politics for decades. His investor group owns about 10% of the company and wants to buy more: The Norcross group has submitted a non-binding proposal to buy $100 million in stock.

The offer comes with strings attached. The Norcross group last year indicated it wanted the bank to appoint Gregory B. Braca, Former President & CEO of TD Bank’s U.S. operations., as CEO.

While The Norcross group has backed off the request to put Mr. Braca in the CEO seat, it still has its eyes on the board. In a recent interview with S&P Global, Mr. Braca said the group wants “meaningful” board representation that’s “commensurate” with the size of its investment.

Such representation could amount to near or actual control of the board. The bank’s market capitalization is only about $120 million, so a $100 million equity purchase could mean roughly doubling the share count.

The list of asks from the Norcross group goes on. One surprising request is for a generous expense reimbursement. In December, the Norcross group wanted $10 million to $12 million in expense reimbursement but has since reduced the request to a maximum of $9 million.

Source: SEC Filing

But even $9 million is a hefty amount and experts say it raises questions about how seriously the Norcross group is taking corporate governance. In a normal PIPE, or private investment in public equity, investors aren’t generally paid a cash fee to take shares but rather choose to invest based on the merits of the deal.

“It’s odd from a corporate governance perspective,” University of Pennsylvania Law School’s Charles Elson told CorpGov in an interview. “It looks like they’re paying themselves a reward for taking control – as opposed to a premium. Put another way, they’re not investing $100 million but only $90 million.”

Of course, investment banks may charge a fee to execute a PIPE and the Norcross group has engaged another investment bank, Raymond James. But investment bankers not involved in the situation say a typical fee for a deal of this profile would probably be 5% or less.

That makes it unlikely investment bankers are the reason for the large fee. The Norcross group has said in its own filings that the expenses include other costs including litigation against the company – effectively the activism campaign itself. The group is working with white-shoe law firm Sullivan & Cromwell which is known for serious fees.

What’s more, the Norcross group said it wants reimbursement for an undisclosed amount of “compensation expenses” paid to Mr. Braca. Again, that’s an unusual request – particularly at this stage of the game. Activists who settle are often able to recoup some expenses when they cut deals but there’s no such settlement in sight.

Professor Elson added that it’s “much too soon” to be make sweeping board changes. The bank has added three new directors (out of a total of seven) in the last several months – all of whom have relevant experience. One is the new CEO, Thomas Geisel, who only joined the bank in December. His resume includes nearly eight years at Webster Financial Corp.’s Webster Bank (formerly Sterling National Bank) where he was President, Corporate Banking. With an $8.8 billion market capitalization, Webster dwarfs Republic First.

The second new director is Benjamin C. Duster, IV, a veteran independent public company director who serves as Chairman of the Audit Committee of the Board of Directors of Chesapeake Energy Corporation, the Chairman of the Compensation Committee of the Board of Directors of Weatherford International, Inc., and a member of the Board of Directors of Diamond Offshore Drilling, Inc.

Finally, Driver Management was given one board seat as part of its settlement and chose Peter Bartholow, Texas Capital Bancshares’ former Chief Financial Officer, Chief Operations Officer and board member. Texas Capital has a market capitalization of $3.2 billon (more than 25 times that of Republic First) and its stock has consistently performed better than Republic First’s in recent years.

In an interview with CorpGov, Driver Management’s Mr. Cooper declined to comment about the Norcross group but said he was pleased with the direction of the company in the last few months. “It takes time,” he said, adding that he’s hopeful that the strategic review underway since the fall will bear fruit.

Indeed, Republic First is conducting a strategic review and hired financials-focused investment bank Keefe Bruyette & Woods to explore options. The Norcross group, while submitting a non-binding proposal, hasn’t formally engaged in that strategic review process, which may lead to a capital raise.

That cash is important because it can be used to extend loans that generate decent interest income. Right now, a great deal of the bank’s capital is tied up in long-dated bonds it probably doesn’t want to sell at a loss. New cash would allow the bank to build its loan asset base while waiting for some of those bonds to mature.

Republic First declined to comment to CorpGov. In an interview with CorpGov, Mr. Braca emphasized that the bank needs capital urgently and argued that the internal review has taken too long. “It’s been going on since September,” he said “What’s going on here? It’s not the biggest deal.”

Mr. Braca also questioned the credentials of the three new directors, including Mr. Geisel, who has only been CEO since December. “He may be qualified and he’s run some small banks before – it remains to be seen. The directors aren’t all bankers per se and one is from Texas – not the core market.”

While the Norcross group does own 10% of the stock, it’s notable that the current board owns a lot as well – roughly 17% of the company. Hedge fund billionaire Steven A. Cohen owns 8.53% through his family office, Driver Management has 1.21%, and together Harris Wildstein and Harry Madonna have 6.9%. That large ownership should help ensure that the board’s interests are aligned with those of all shareholders.

Given the quality and short tenure of three new directors, a CEO with industry experience and a strategic review underway with a well-known institution, there seems little reason to overhaul the board – let alone give the Norcross group significant control of it. The best move is for Republic First to keep its eye on the prize and avoid other distractions.

Contact:

CorpGov

www.CorpGov.com

Editor@CorpGov.com