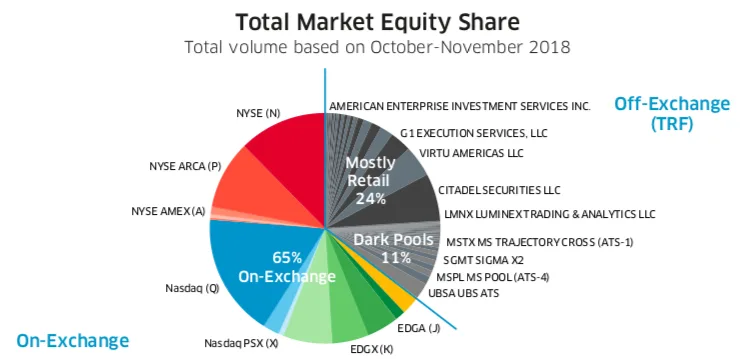

Stocks Trade Across 88 “Lit” and “Dark” Venues (Source: Nasdaq Economic Research, FINRA)

Small, illiquid stocks may actually suffer from exposure across too many platforms and would benefit from trading on just one “lit” home exchange such as Cboe’s EDGX, NYSE’s AMEX, or Nasdaq.

That’s according to a new paper by Nasdaq entitled “TotalMarkets: Blueprint for a Better Tomorrow” designed to improve market structure in a way that encourages more companies to list publicly. In recent years, companies have waited longer and longer to go public in part due to thin trading and wide spreads on their shares. Nasdaq argues that many of today’s rules were designed with a one-size-fits-all mindset that isn’t effective for fostering trade in small companies.

One issue is the proliferation of trading venues, with an amazing 88 different places where stocks currently trade. A “lit” exchange refers to a venue where bids and offers are posted publicly so anyone can see them. That contrasts with “dark” venue such as a dark pool or a wholesaler like Citadel Securities. “Dark” venues are effectively guided by “lit” venues because they are forced to offer prices that are as good or better than what’s available publicly.

The reason to reduce trading across many “lit” exchanges? Simplification may facilitate tighter spreads and more trading, according to Nasdaq Chief Economist Phil Mackintosh.

Mr. Mackintosh said that market makers can use computers to create “a virtual book” but it requires them to include up to 13 “lit” exchanges. Since market makers want to be neutral, they need to post both bids and offers, but can’t offer the same size 13 times, so the bids and offers they post wind up being smaller. By contrast, if a market maker could concentrate the number of shares it’s willing to buy or sell in one place, that venue could offer superior liquidity, he said.

“We’re not saying to take trading off of the dark venues,” Mr. Mackintosh added, saying that they can continue to offer better prices. That should “offset any fears of a primary venue not having competition.”

Phil Mackintosh, Chief Economist, Nasdaq

Indeed, Mr. Mackintosh said that retail stock orders often wind up being routed to a “dark” venue wholesaler, which will attempt to offer a better price. That can mean beating the “lit” exchange by a small fraction of a cent. (Dark pools generally don’t handle retail trades, he said).

Another suggestion in the paper designed to drive liquidity is to allow some stocks to trade in smaller price increments. At the moment, stocks trading above $1 a share can only have publicly-posted bids and offers in increments of $0.01.

“Once cent trades simply don’t work for all stocks,” Mr. Mackintosh said. “It can create long queues for large companies that happen to trade for a few dollars a share and there are bid-offer games that can result.”

He points out that a once-cent spread on a two-dollar stock implies a full one percentage point to get in and out of a stock – at best. Such a high transaction cost can strongly discourage trades in some securities when demand is actually very high.

Another problem Nasdaq addresses is the definition of “professional” and “non-professional” users in market data agreements. At the moment, most investors with a brokerage account at, say, Schwab or Fidelity, get access to market quotes without paying a fee. That contrasts with institutions, which pay fees for data they may use for high-frequency trading purposes.

But some investors with millions of dollars under management at retail brokers still get away without paying any fees. “There are old-fashioned definitions of professional and non-professional,” Mr. Mackintosh said. “A very active trader might avoid paying fees by choosing to open an account at a retail brokerage.”

Nasdaq’s paper highlights other proposals around the way orders are processed, allowing small “lit” exchanges to better compete with non-exchange “dark” venues. Ultimately, Mr. Mackintosh believes that with liquidity spread across so may sources for U.S. stocks, rules created in the 1990s no longer fit.

“Markets have modernized and rules should as well,” he said.

Contact:

John Jannarone, Editor-in-Chief

www.CorpGov.com

Twitter: @CorpGovernor