Deposition Suggests Globalstar Sought to Sway “Fairness Opinion” Prepared by Investment Bankers

As the controlling shareholder of Globalstar, Executive Chairman Jay Monroe is accustomed to getting his way. Did he extend his reach too far with investment bankers in a failed attempt to merge the company with his own assets?

The satellite-communications firm has been at war with number-two shareholder Mudrick Capital Management since April when Globalstar announced an all-stock deal to acquire some of Mr. Monroe’s other assets in a $1.65 billion transaction. The planned merger, which the company canceled in August, would have diluted minority shareholders such as Mudrick Capital while sending Mr. Monroe’s stake from 58% to nearly 90%. The deal was almost universally panned, with the stock sinking after announcement and analysts at Cowen and Morgan Stanley calling out a rich valuation.

How did Mr. Monroe attempt a deal that many saw as flagrantly unfair to other shareholders? Part of the answer may lie in a so-called fairness opinion, a report investment banks typically prepare for companies before they approve M&A transactions. In most cases, fairness opinions don’t draw much attention, partly because deals usually are negotiated at arm’s length. In Globalstar’s case, there was no shareholder vote on the deal, but rather a review by a Special Committee comprised of four board directors who relied partly on the fairness opinion.

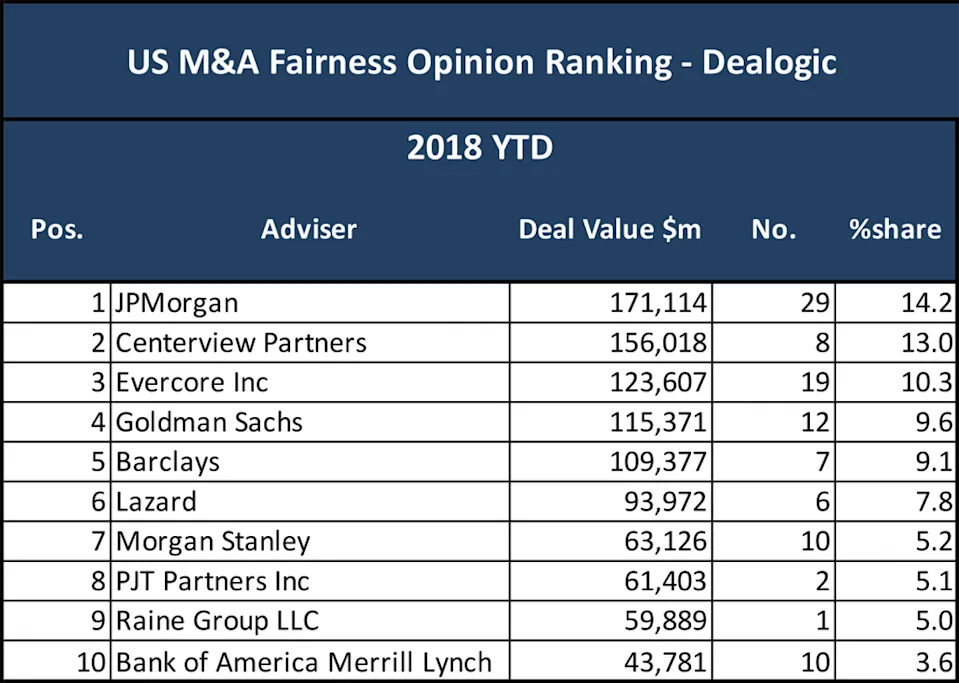

Earlier this month, Mudrick Capital filed a subpoena for documents from Moelis & Company, the boutique investment bank that provided the fairness opinion related to the doomed merger. Moelis was at least the fourth investment bank Globalstar had contacted regarding Mr. Monroe’s assets: The company had been working with Centerview Partners and Allen & Company since 2015 (both remained engaged as of August) and later reached out to Houlihan Lokey, another boutique, to discuss a fairness opinion for the proposed merger. Mudrick has also issued subpoenas for documents to Centerview and Allen. All four investment banks either declined to comment or didn’t reply to requests for comment from CorpGov.

The fairness opinion itself hasn’t been made public, but it was reviewed along with other documents by Jason Mudrick, president and chief investment officer of Mudrick Capital, who was deposed in a day-long session in July. CorpGov reviewed a transcript of the deposition, which sheds light on how the merger proposal was developed.

First, Houlihan Lokey may have been passed over on the fairness opinion assignment in part because the boutique wanted to do too much of its own objective analysis. Chris Wilson, a managing director and co-head of Houlihan’s technology media and telecom group, contacted Mr. Mudrick after the merger announcement to tell him that Houlihan had been in the running.

“Chris [Wilson] told me that it became very clear in those conversations that the company didn’t like the answers Houlihan was giving them. He said to me they were looking for the answer followed by the analysis and not the analysis that would lead to an answer,” Mr. Mudrick said in the deposition. “He said to me that it was very clear they were looking for a bank to rubber-stamp the merger, not an actual fairness opinion.” Mr. Mudrick declined to comment to CorpGov.

While Centerview and Allen often prepare fairness opinions, they didn’t write one for the proposed merger. However, they did conduct at least some analysis of FiberLight, the largest of the assets Mr. Monroe wanted Globalstar to purchase. Mr. Mudrick reviewed documents detailing the two boutiques’ valuations of FiberLight, and said they were “significantly lower” than Moelis’s.

Earlier this year, Globalstar chose Moelis for the fairness opinion. (Mr. Mudrick at the time was friends with Moelis Managing Director Lawrence Chu, whom he knew from a gym where they both worked out. According to the deposition, Mr. Mudrick in fact introduced Mr. Chu to Globalstar prior to the merger announcement, though it’s not clear if Moelis as a firm had pre-existing relationships with the company).

After hiring Moelis, the Special Committee at Globalstar instructed the investment bank to rely on financial projections provided by the company, according to Mr. Mudrick in the deposition. Moelis “didn’t do an independent analysis” of those projections, he said.

Of course, it’s common for investment banks to rely on a company’s own financial data when that company is private. And fairness opinions aren’t endorsements of deals at specific prices; rather, they indicate possible “fair” valuation ranges that can be very wide. And investment banks like Moelis tend to have strict rules around the preparation of a fairness opinion. For instance, firms sometimes call in bankers from groups of the firm who have had no contact with the client, so to reduce the risk of bias.

However, any evaluation of the deal should arguably have included an analysis of Globalstar itself, given that its stock was being used as a currency to buy Mr. Monroe’s assets. During a conference call in January 2017, Mr. Monroe agreed with Mr. Mudrick’s analysis that Globalstar’s equity should be worth $8.7 billion, or $6.60 a share. The day before the merger announcement, the stock was trading at just $0.73 a share and has since fallen to $0.33 a share.

Why might Mr. Monroe have a drastic change of view? One possible explanation: Under the proposed merger, Mr. Monroe actually had an unusual incentive for Globalstar shares to be cheaper. The lower the value of Globalstar stock, the more shares would be required to purchase assets from Mr. Monroe, leading to a higher stake for him in the post-merger company.

There is also some question of whether the Special Committee could actually perform an independent analysis. It’s true that the committee members – J. Patrick McIntyre, William Hasler, Kenneth Young and John Kneuer – are the only members of the Globalstar board who don’t work directly for Mr. Monroe.

But earlier this year when the Special Committee negotiated some key terms of the merger, which would dilute minority shareholders, each member received a grant of 225,000 Globalstar shares as compensation. The company worked without an investment bank as a formal advisor; Moelis had a specific assignment to prepare a fairness opinion.

One purported motivation for the merger was to shore up Globalstar’s balance sheet, which is hobbled by a quickly-amortizing loan that requires substantial cash payments. But back in January 2017, Mr. Mudrick offered on a conference call to make a loan to the company. And in April 2018, just a couple of weeks before the merger announcement, Mr. Mudrick sent a public letter offering a $150 million loan to reduce the near-term strain.

For Moelis’s part, Mr. Chu seemed to urge the Special Committee to consider the loan package rather than focus solely on the merger. “Lawrence Chu told me that he had instructed the Special Committee to engage with me and they told him they would, and that he was surprised to hear that they didn’t,” Mr. Mudrick said in the deposition.

Globalstar, which will report quarterly results on Thursday, declined to comment.

Contact:

John Jannarone, Editor-in-Chief

www.CorpGov.com

Twitter: @CorpGovernor