- Activist investor Nelson Peltz staging rare proxy fight The Walt Disney Co. (NYSE: DIS)

- Unlikely to find any quick fixes with M&A – neither via acquisitions nor sales

- Margins likely squeezed for years, indicating executive comp should be cut

- Peltz’s experience in tech, media is limited and track record outside consumer is questionable

- Need media expertise, relationships to navigate the shift to streaming with Disney+

- Cord cutting continues, making traditional distribution model unsustainable

- Real competitors include Netflix, Inc., others offering Advertising Video on Demand

There’s an old-school barbarian at the gates of The Walt Disney Co. (NYSE: DIS). But before granting him or any other Wall Streeters entry, Disney should look for answers within the fast-changing media industry its management team knows best.

Investor Nelson Peltz, famous for Michael Milken-financed takeovers in the 1980s, wants a board seat at Disney and has mounted a proxy fight after failing to negotiate for a spot directly. The appeal to Mr. Peltz is clear: Disney shares are about 50% off their peak, there appears to be some low-hanging fruit to boost the bottom line, and last, but not least, there’s significant prestige for the 80-year-old investor who may have legacy at the top of his mind.

Some of Mr. Peltz’s suggestions are spot on – and probably things “boomerang” CEO Bob Iger (who’s back after a short retirement) and the Disney board agree to be true. First, investments in content were likely overblown in a race to keep up with deep-pocketed rivals.

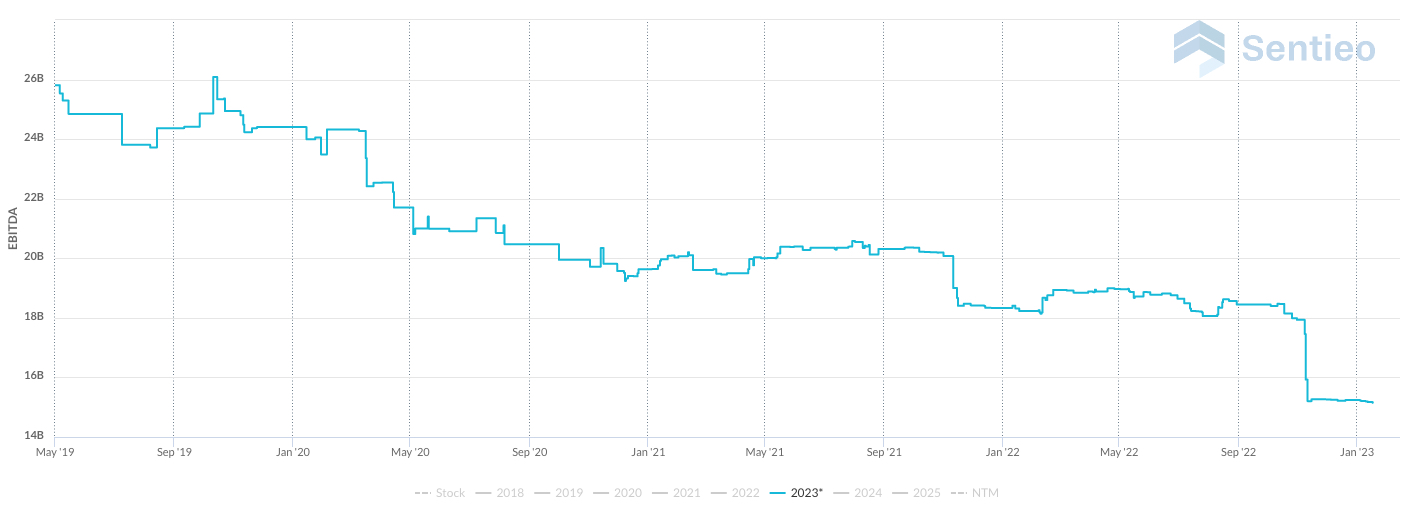

Second, almost no matter how you slice it, the $71 billion acquisition of 21st Century Fox looks regrettable. Since that deal closed in 2019, expectations for Disney’s future profits have edged steadily lower. Consensus 2023 Ebitda projection have declined from $26 billion in 2019 to just $15 billion today, according to Sentieo, an AI-enabled research platform.

Consensus 2023 Ebitda Forecast Over Time – Sentieo

But while Wall Street expectations dimmed, Disney kept up with an old media industry tradition: lavish pay packages even for executives a few rungs from the top. This week, The Wall Street Journal noticed in a filing that former communications chief Geoff Morrell earned an estimated $8,365,403 in total compensation for working just 70 weekdays. Outgoing CEO Bob Chapek (who was fired in November) was also paid a handsome sum: Mr. Chapek earned a total of $24 million in 2022 and is entitled to about $6.5 million in the remaining base salary of his nearly three-year contract along with an additional bonus for fiscal 2023.

But those figures don’t even look wild compared with compensation under the Iger administration in the years up to his departure. Mr. Iger, like many big media CEOs, was paid tens of millions annually and even his underlings, including former communications chief Zenia Mucha and General Counsel Alan Braverman, received lavish paychecks. Steve Lipin, a spokesman for Disney, didn’t respond to a request for comment from CorpGov.

2021 Compensation Table – SEC Filing

Cutting back on such packages should be simple enough for Disney’s management and board to understand. Now the company is under extreme scrutiny, it would be reckless to ignore bloated pay packages while shareholders suffer.

The real work is navigating Disney’s shift from pay TV to streaming services in a viciously competitive industry where margins are shrinking. That will require executives to roll up their sleeves and perhaps accepts more modest pay for the time being.

In fairness to Mr. Peltz, he has plenty of experience as a director at large companies. And people close to his past campaigns say he is backed by savvy analysts who help offer advice to boards even on complex matters. But it’s been widely reported that his track record outside of his core consumer focus isn’t stellar. Reached by telephone, Mr. Peltz directed CorpGov to his the office of his firm, Trian, which didn’t reply to a request for comment.

There is no quick fix to the trouble Disney faces. Traditional pay TV – mostly cable and satellite – continues its precipitous decline. When people cancel a monthly package, it hurts cable operators like Charter Communications, Inc. and Comcast Corp. for obvious reasons. The only quick solution they have is to raise prices, which can backfire and accelerate cord-cutting trends.

As for the likes of Disney and Warner Bros. Discovery, Inc., the days of raising so-called affiliate fees to cable and satellite companies to carry their content is probably over. From here, it’s a scramble to convert those viewers to Disney+ or Discovery+ subscribers once they cancel monthly bundles.

Disney has a better chance of success than most. After all, almost any household with children is likely to pick Disney over, say, HBO Max because it is wholly dedicated to family content. (Think back to the 1980s when The Disney Channel would trump HBO or Showtime premium subscriptions for households who had to choose just one).

Even so, there is a plethora of family content available from deep-pocketed content companies like Netflix, Amazon and others that have invested billions and billions of dollars in content since the early days of streaming. Making matters more difficult, ad-supported models now allow for cheap subscriptions or even free viewing for people willing to watch lots of ads.

Mr. Peltz seems to suggest this is an easier task than it is. In his recent presentation, he indicates “surprise” that Disney cannot compete efficiently with Netflix. But Netflix and Amazon freely spend on extremely high-quality content. And their business models have often faced little challenge from investors in recent years. Disney continues to state a target of profitability for Disney+ in 2024 – as it has from the very beginning.

What Disney has that Netflix and Amazon do not is decades-long cultural significance and genuine synergies. The “flywheel” across video, movies, toys and parks is real and gives Disney an advantage. Those verticals can all feed off each other in a virtuous cycle that carries on year after year.

But Disney still needs to ensure prominence on the streaming landscape by securing subscribers quickly once they cut the cord – or catch younger viewers who never even had satellite or cable. One way to do so is playing nice with broadband providers that see the writing on the wall and understand it’s smart to offer up streaming choices to subscribers.

There are hundreds of such operators across the country in addition to a handful of heavyweights. Those distributors aren’t the opponents – Netflix and others making big content bets are the real concern.

One other idea that Wall Street often embraces is a big M&A deal to drive quick value (and fat fees for investment bankers). Third Point’s Dan Loeb even suggested Disney sell off ESPN – only to quickly backtrack publicly. The trouble in this market is that such assets probably won’t fetch a good price and such a deal would be a major distraction.

Despite the recent tumult at Disney, Mr. Iger has a long track record of building its brand during his marathon-long tenure. Before inviting in a critic from out East, give him a little time get the House of Mouse in order.

Contact:

CorpGov

www.CorpGov.com

Editor@CorpGov.com