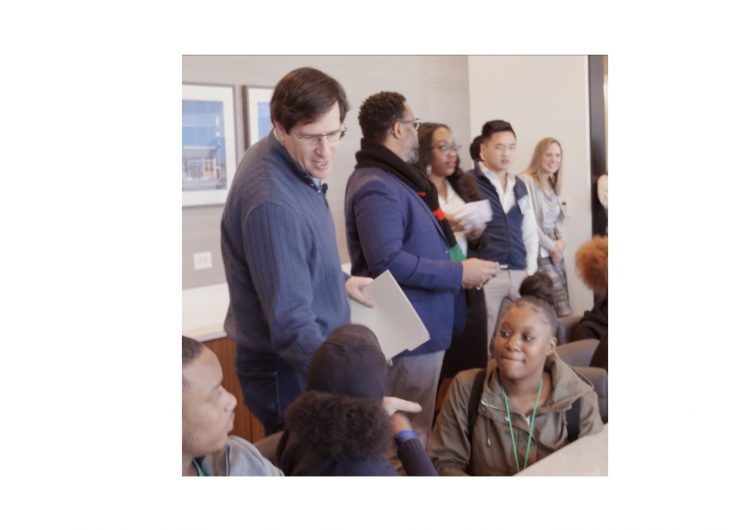

Neal Aronson, Founder and Managing Partner of Roark Capital, Whose Recent Investments Include The Cheesecake Factory Incorporated – Photo Credit: Daryn Kagan

Aside from the likes of KKR & Co. Inc. and The Blackstone Group L.P., private equity firms aren’t known to lead the charge when it comes to philanthropy or environmental, social and governance (ESG) issues. But with a new fund launched to help displaced employees at portfolio companies, Roark Capital may be setting a new standard in the private equity world.

Roark, which manages $18 billion in assets and focuses on consumer and business service companies such as Cinnabon, Buffalo Wild Wings, and The Cheesecake Factory Incorporated, created the Roark Portfolio Employee Assistance Fund in the wake of the coronavirus pandemic, which has impacted employees at restaurants and other portfolio companies severely. The Assistance Fund has raised $8 million, well above the $5 million target it set at launch, and achieved nearly 100% participation from firm employees.

“Roark’s primary goal is to help people and companies realize their potential….our Core Values define how we make that happen….and we’re proud that our actions match our words,” Roark’s Founder and Managing Partner, Neal Aronson told CorpGov. “Our philosophy is to treat everyone the way you want to be treated, always do what you say, and always do what’s right and long-term smart, regardless of conventional wisdom.”

The decision to launch the Assistance Fund reflects on Roark’s long-term mindset and is also part of a formal framework that remains rare at private-equity firms. Similar to major institutions such as Blackrock, Inc. and State Street Corporation, which have dedicated governance and ESG groups, Roark employs a Head of Diversity and Social Responsibility, Allison Hill.

“It may be unconventional, but just like our long-term investment thinking, we needed to have dedication and focus in order to make a long-term impact on people and our community,” Ms. Hill said.

Roark’s approach also echoes a much broader emphasis on social responsibility that has become a key discussion topic between investors and corporations across Wall Street. For instance, Martin Lipton, Founding Partner of Wachtell, Lipton, Rosen & Katz, advocates a progressive approach to corporate governance called The New Paradigm, which argues for companies benefitting not only shareholders but other stakeholders such as employees.

How will the Assistance Fund money be deployed? One portfolio company that may help direct the funds to those in need is Primrose Schools, an early education and childcare provider which was founded in 1982 and became a Roark portfolio company in 2008. Rather than disburse money to staff from Primrose itself, the company intends share it with teachers who have lost their jobs at any of its 423 schools, which are owner-operated franchises.

“From the onset, social responsibility has been embedded in our culture,” Primrose Schools CEO Jo Kirchner told CorpGov. Ms. Kirchner said that the school has always had a focus on creating a brighter future for all children, having been founded by a woman who couldn’t find adequate childcare.

The coronavirus pandemic has been particularly difficult for preschools. At Primrose, student occupancy is down roughly 75%, with only children of critical workers in attendance and many teachers put on unpaid leave.

Ms. Kirchner said she gave considerable thought to the implications of private equity ownership well before the deal happened. Her conversations with Mr. Aronson convinced her the business would be in good hands.

“I met Neal two years before the acquisition and in that process, we talked about business values, philosophy, and integrity,” she said. “We had lots of conversations about why businesses exist – including their responsibility to improve communities where they operate.”

She added that Mr. Aronson made clear his firm aimed to be “a good partner in good times and a great partner in bad times,” which made her comfortable with Roark.

Fundraising efforts went beyond Roark employees to include supply partners, investors, and advisors. Mr. Aronson and his wife personally contributed a matching $3 million contribution.

In addition to the Assistance Fund, Atlanta-based Roark has a community strategy for the firm called “Change the Equation” which is focused on working closely with non-profit partners to help kids achieve long-term educational success. The program addresses shortcomings both inside and outside the classroom, offering wrap-around support and services to help break the generational poverty cycle.

Roark also focuses on diversity and inclusion, with educational programs and workshops along with a recruiting approach designed to create sustainable change. Additionally, Roark works with top women leaders at its portfolio companies to develop a vibrant Women’s Network. The combined efforts aim to strengthen a diverse talent pool both within the firm and at portfolio companies.

The Assistance Fund money will be provided to Roark companies to seed new funds and to bolster programs already in place. Roark plans to allocate the funds to do the greatest good for the greatest number, addressing the most pressing needs such as paying rent, buying food and covering other essentials. All grants will be tax-free to the recipient, and all administrative fees will be paid by Roark.

Contact:

John Jannarone, Editor-in-Chief

www.CorpGov.com

Twitter: @CorpGovernor